Accounting standards such as the ASC 842 and IFRS 16 involve elaborate functions and crucial calculations that can eat up your employees’ productivity if you use manual methods. Instead, you should use reliable lease accounting software. It instantly and efficiently offers the needed functionalities and calculations to follow the financial reporting standards for your lease contracts. One robust lease accounting software and must-have tool to streamline your business operations is Trullion. In this guide, we’ll walk you through its functions and the various ways it streamlines related workflows for your ready compliance. But first…

What is Trullion?

Trullion is a SaaS platform powered by artificial intelligence (AI) that automates accounting workflows for accountants, CFOs, and auditors.

What is Trullion?Extracting Contract Details with AIVisually Modifying Contract DetailsAdjusting Agreement Details in BulkStreamline Your Lease Accounting and Compliance Now with Trullion

It merges structured and unstructured accounting facets by reading contracts and automatically translating them into financial workflows and one-click journal entries — all of which remain linked to their data sources. Trullion even transforms your lease information into live 360-degree visual accounting data and reports compliant with ASC 842, IFRS 16, and GASB 87. This function enables controllers, CFOs, and their partners to collaborate seamlessly in one integrated platform. Trullion is trusted by several leading industries such as RigUp (now Workrise), KPMG, Bell Industries, Eisai Co., Ltd., HMD Global (creator of Nokia phones), and even the Bernalillo County government of the US state of New Mexico, among others.

Extracting Contract Details with AI

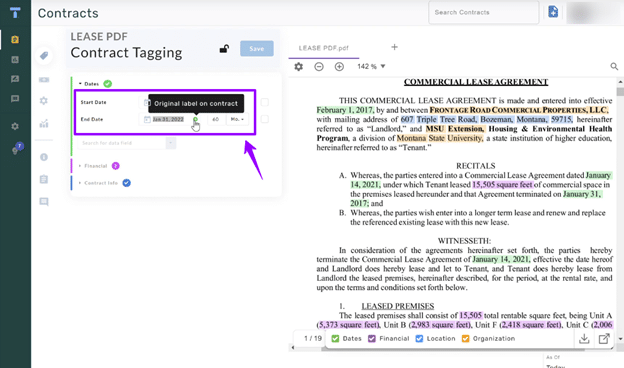

To begin converting your contract into a financial document, upload or drag-and-drop your PDF or Excel file into the Trullion software. The AI then scans it with optical character recognition (OCR) and machine learning to analyze and uncover relevant information. Once the AI finishes scanning, you’ll see the extracted data inputs aligned with the financial reporting standards. Trullion further suggests some data points (e.g., January 31, 2022 for the end date) which you can review and approve.

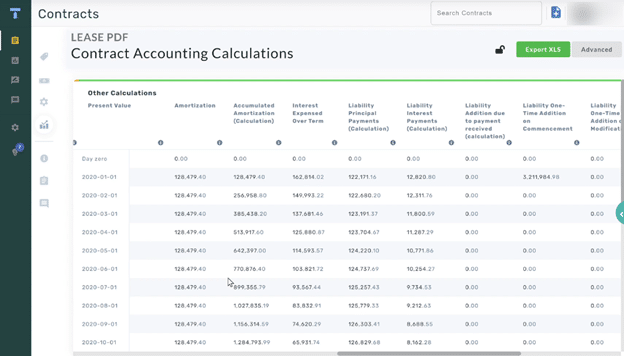

Trullion also has reporting functionalities. You can go through each step prescribed by the said regulations and produce your right-of-use (ROU) assets, liabilities, and other entries. When you’ve uploaded all necessary contracts, you can create a report — such as a journal entry report of all entries for any period you wish to cover.

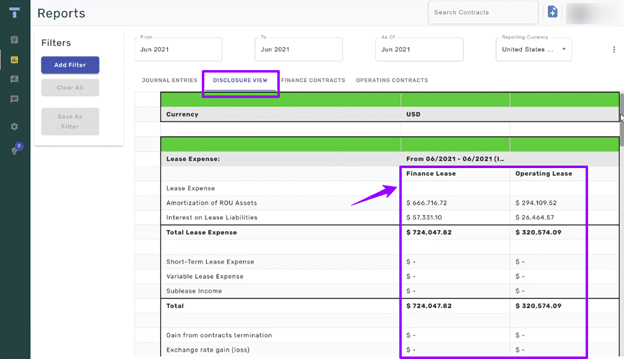

You can even choose a disclosure report. This function lets you select a reporting period, view journal entries and relevant contracts, and see a disclosure (which displays the accounting data classified into finance and operating leases under ASC 842).

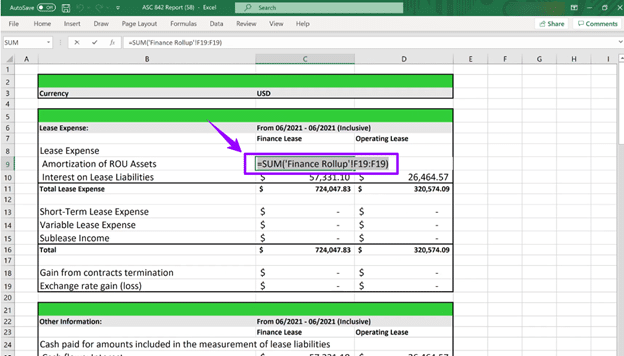

Trullion displays the weighted averages, maturity analysis, and even a roll forward in balance sheet reconciliation. Once you’ve completed your report, you or your auditors can export the data into Excel and review its accuracy. On your downloaded spreadsheet, you can click on any cell and see the exact formula used. This gives you 360-degree visibility into your audit trail.

Additionally, Trullion lets you probe into the workbook and click on data items and disclosures to see the contracts involved. When you click on one, Trullion takes you back to the original agreement on the software for your reference.

Visually Modifying Contract Details

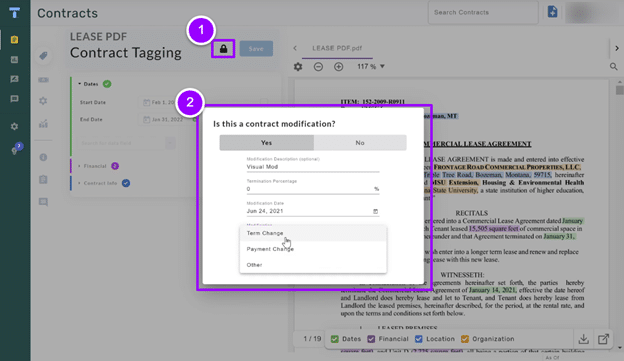

Trullion helps you apply visual modifications to your agreements and accounting documents according to the new lease accounting standard, GASB87. Once you’ve finished reviewing your lease on Trullion, you can lock the document, making it a read-only financial record. If you have any agreement updates to integrate, you can unlock the said contract and process the adjustment — which can be a lease renewal, change on the terms and payments, etc.

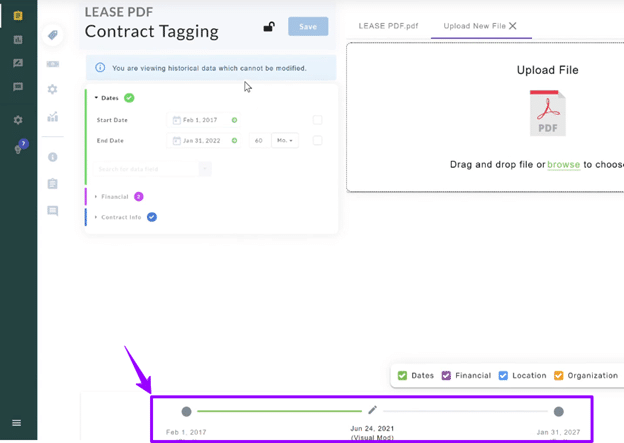

When you’ve inputted the new details, click the modification button to open the workflow. You can add a new document file or payment and extend or adjust the agreement’s data points. With this visual modification feature, you’ll then see a timeline created at the bottom of the software screen.

The initial phase of the timeline (“Start” to “Visual Mod” in the image or your inputted modification description) shows the historical information, while the latter part displays the current data. When you check your report, you and your auditors can instantly view the active record. You can always see your records’ historical data, specifically the pre- and post-modification details.

Adjusting Agreement Details in Bulk

Trullion also offers bulk adjustment functionality that is ideal for:

Companies with large asset portfolios Organizations and auditors who have already taken on the lease data into Excel, and Auditors trying to modernize their workflows.

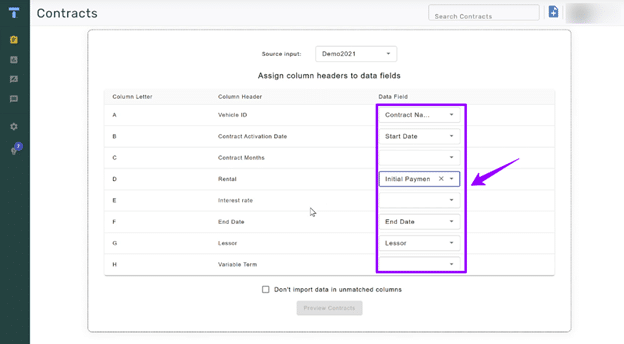

To start, upload a worksheet of leases using your or Trullion’s template. If you proceed with your spreadsheet, the system detects the column headers within your data. Here, you can match them with your desired data fields — consisting of a unique identifier, activation date, etc.

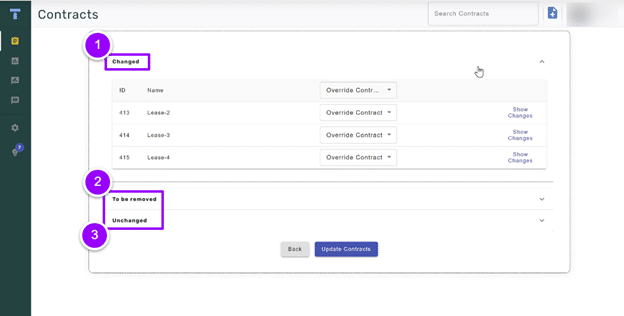

You can then preview, approve, and instantly import the data (which can be month over month, quarter over quarter, or year over year). Once it’s imported, you can click on it and see any leases within the software. For example, let’s delete four records, extend three lease agreements to three more years, and save a copy of the file. When I upload it on Trullion, the system remembers the data fields used previously. When you review your data, Trullion shows the adjustments in three categories. First, it displays the changes applied to the document, specifically the old and new values. You can select whether or not these are modifications, when the adjustment date is, and if it is only a non-material update.

Second, Trullion detects and shows the removals, which are assets no longer seen in the spreadsheet. You can also decide whether to terminate, ignore, or change them. Lastly, Trullion will list the unmodified details, which will continue as is in the sheet. This bulk functionality is practical when updating the data in large volumes, as in new charts of accounts or the latest reporting entities.

Streamline Your Lease Accounting and Compliance Now with Trullion

Trullion helps your business comply effortlessly with the ASC 842, GASB 87, and IFRS 16 standards with its smart automation features. By letting AI automate your lease accounting workflows, you simplify your work and minimize expensive errors. You can also remain confident about your financial data, increase your efficiency, and focus on tasks that contribute directly to your business’ profitability and success.